What Is the Rebalancing Trading Strategy?

Why Rebalancing?

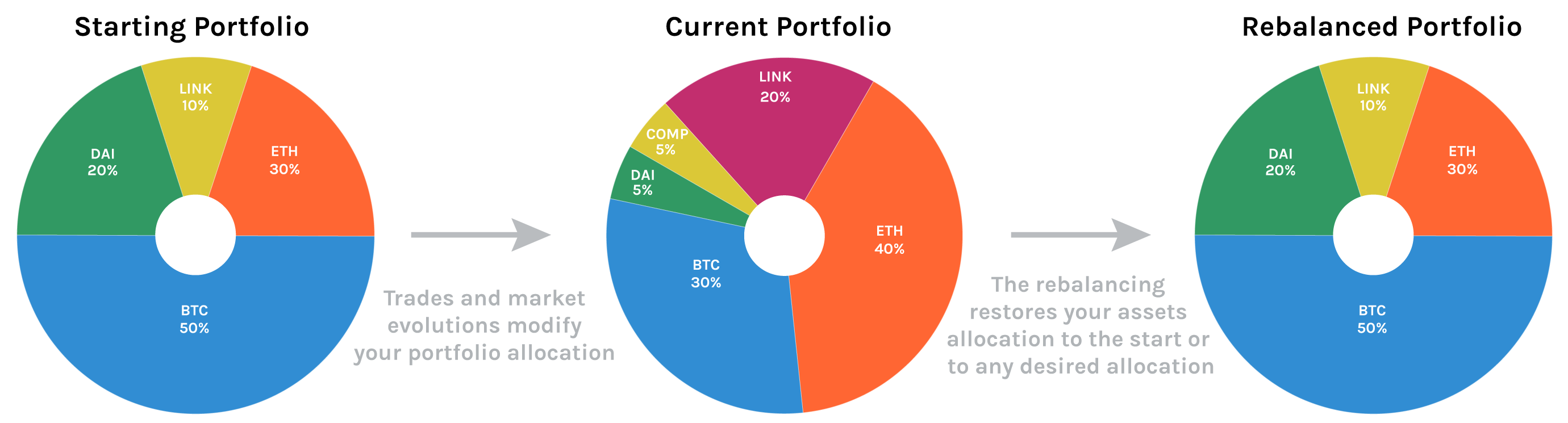

Rebalancing is a strategy that involves maintaining a predetermined ratio of multiple spot assets. When the value of a position surpasses the “Threshold,” it is sold and the proceeds are used to buy a lower value cryptocurrency, bringing the portfolio back to its initial position.

Rebalancing offers the benefits of portfolio management, risk diversification, and long-term investment.

In the short term, selling high and buying low may result in an increase in the quantity of some cryptocurrencies and a decrease in others. Considering the market’s volatile nature, continuously adjusting the positions in the cryptocurrency portfolio helps maintain the proportional value between different cryptocurrencies within a certain range. This effectively mitigates the impact of sharp market fluctuations on your investment returns.

By reallocating profits to other cryptocurrencies within the portfolio when the price of a particular cryptocurrency rises significantly, the overall value of your investment portfolio can experience steady growth. Similarly, when prices decline, the overall portfolio value tends to decline less compared to a specific cryptocurrency, ultimately leading to more stable returns.

As Market Volatility Persists, Your Overall Cryptocurrency Holdings Will Continue to Increase

How Do I Configure a Cryptocurrency Portfolio in Rebalancing?

- Select cryptocurrencies that have a bullish outlook and hold them for the long term.

- Choose cryptocurrencies that exhibit volatility.

- Opt for cryptocurrencies that display price regression.

- Select cryptocurrencies with similar levels of volatility.

- Choose cryptocurrencies that are from different fields and have significant differences in attributes.

- Maintain a portfolio with evenly distributed values across different cryptocurrencies.

What Is a Reasonable Rebalancing Period or “threshold” Setting?

The setting of the Rebalancing period or “Threshold” needs to refer to the level of the transaction fee, and the higher the general fee, the larger the value of the setting.

AntBot’s Rebalancing bot is completely free, and the exchange’s spot trading fee is generally 0.1% (e.g Binance).

When Rebalancing reaches the condition, it will only sell high and buy low for the part of the portfolio that is out of value, so the trading volume caused by the rebalancing is generally a small part of the position.

The rebalancing ratio of traditional financial products is generally set at 5%-15%. The volatility of cryptocurrencies is relatively high. It is recommended to set it at 10%-20%. The rebalancing ratio must be set according to the properties of different cryptocurrencies.

Description of Rebalancing Parameter Configuration

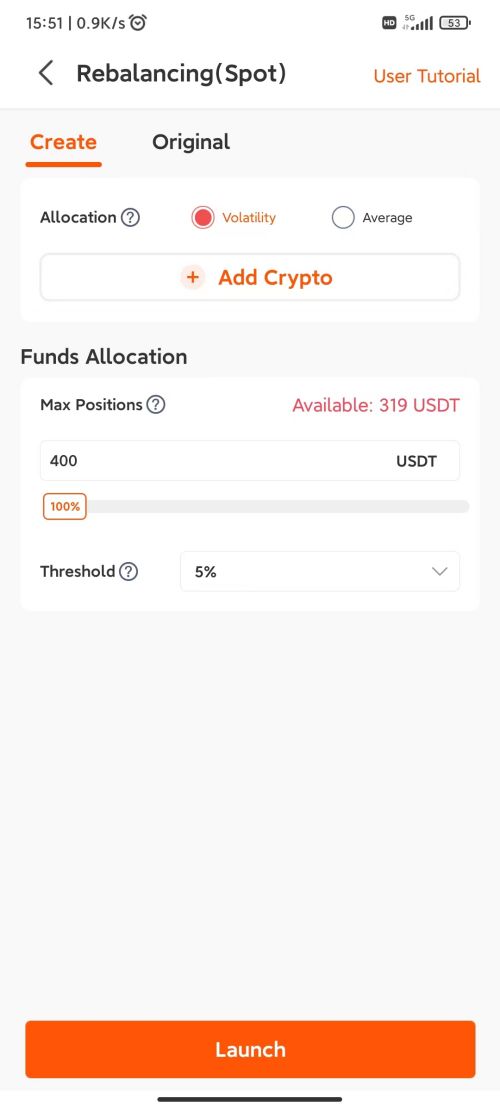

AntBot’s rebalancing robot has two modes: creating positions and using original positions.

We first introduce creating positions. When you choose this method to start the robot, different proportions will be allocated according to different cryptocurrencies, and then the position will be opened.

Allocation method, i.e. the value of each cryptocurrency as a percentage of the total expected investment after the user adds the cryptocurrency. AntBot offers the following 3 ways to allocate the share of each cryptocurrency:

- Average: distributed equally according to the value of the currency, suitable for cryptocurrency combinations with similar volatility.

- Market Cap:which refers to the ratio of the circulating market value of each cryptocurrency to the total circulating market value of the selected cryptocurrencies.

- Volatility: It is the ratio of the true volatility (ATR) of each cryptocurrency to the sum of the true volatility of the selected cryptocurrencies.

Rebalancing Threshold: Reaching this preset value at the latest market price where the difference between the valuation ratio of at least one cryptocurrency and its initial proportion causes a rebalancing action to return to the initial proportional state. The default Rebalancing Threshold is 5%.

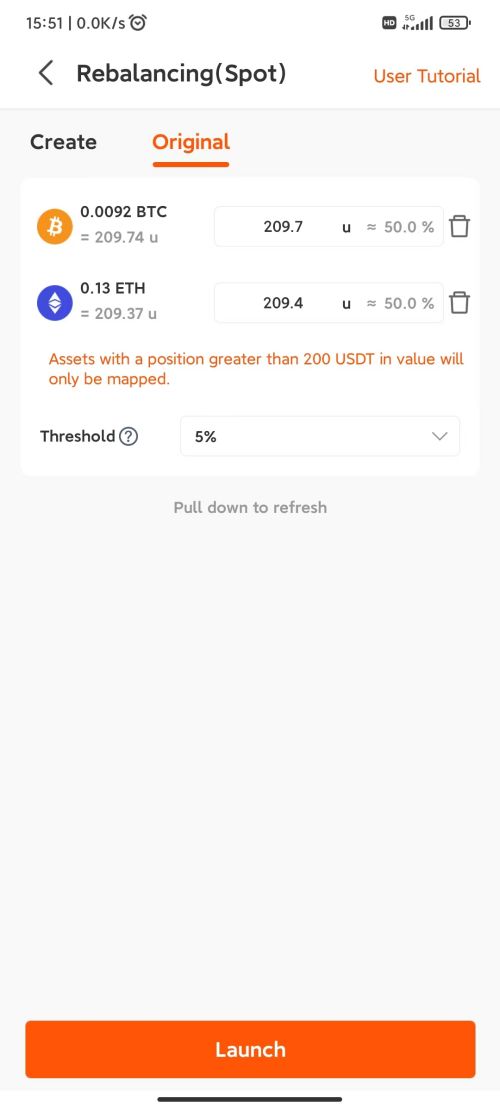

In original position mode, the robot will actively read your spot assets on the exchange. The robot only reads assets with a value greater than 200 USDT and then displays the ratio based on the value share. When the robot is activated it will rebalance in the original cryptocurrency by a set percentage.

References

The Rebalancing Bonus— Bernstein

Diversification, Rebalancing, and the Geometric Mean Frontier — Bernstein

Case Studies in Rebalancing — Bernstein

Portfolio Rebalancing in Theory and Practice — Vanguard

Value of Rebalancing — Sigma Investing