What Is the AI DCA Trading Strategy?

Contents

- The DCA (Dollar Cost Averaging) Trading Strategy Profit Principle

- Improvement of the AI DCA Trading Strategy

- What is Dual DCA Strategy?

- Explanation of AI DCA Parameters

- How to start a bot of AI DCA Bot?

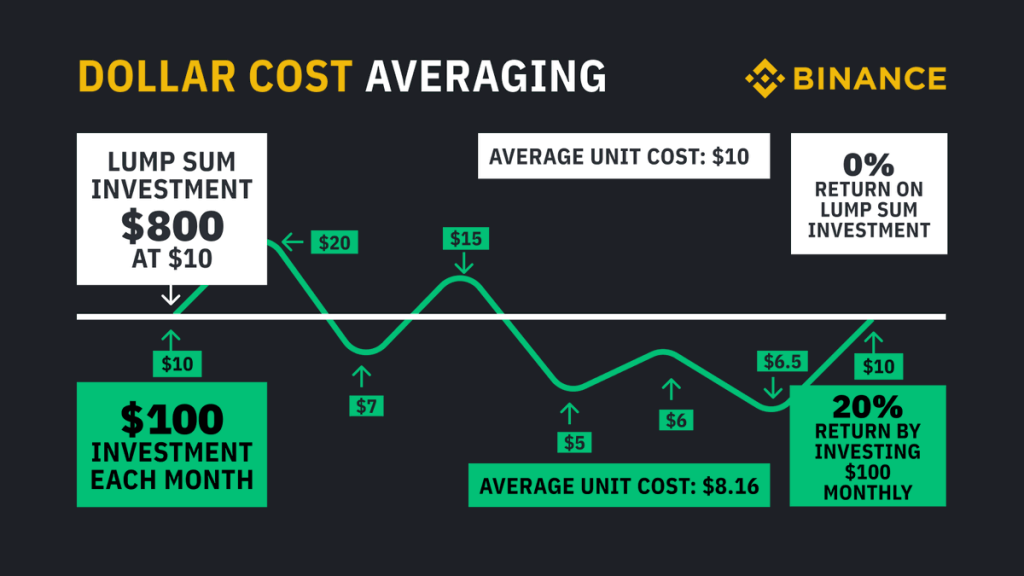

1. The DCA (Dollar Cost Averaging) Trading Strategy Profit Principle

The profit principle of the DCA trading strategy is based on the method of adding positions to generate returns. When the market price moves in the opposite direction to the trader’s expectations, the trader will gradually add positions to lower the holding cost. When the expected profit from the volatile position reaches the trader’s set profit-taking ratio, the position will be closed for profit.

For example, suppose a trader uses the DCA strategy when buying a certain coin and sets a doubling of the position size every time the price drops by 10%. If the trader’s initial position is 100 coins, when the price drops by 10%, the trader will buy another 200 coins, bringing the position to 300 coins. If the price drops another 10%, the trader will buy another 400 coins, bringing the position to 700 coins. During this process, if the price reverses and rises, the trader will reduce the position at the appropriate time to generate profits.

DCA trading principle schematic:

2. Improvement of the AI DCA Trading Strategy

The intelligent DCA trading strategy is a trading strategy based on DCA’s theory. It balances risk and return by dynamically adjusting trading parameters and adding behavior. Compared with traditional DCA strategies, it has stronger adaptability and risk control capabilities.

Strictly speaking, DCA is a position management method. To use the DCA trading strategy, three issues must be addressed:

- Initial position size: Based on asset volatility properties, AntBot determines the initial position size according to the principle of “stop-loss and fix quantity”. The more volatile the asset, the smaller the initial position size, to control trading risk.

- Multiplier for adding position: AntBot’s default setting for adding position multiplier is 2x. The purpose is to maximize the reduction of the position floating loss ratio for the initial few positions with relatively small position size, and to achieve faster profit taking and closing.

- Position adding interval: AntBot determines the maximum position adding amplitude based on the recent market volatility of each cryptocurrency, and then determines the interval distance for each position adding based on 7 position adding times. This can fully consider the risk situation of each asset, allocate funds reasonably, and improve the utilization efficiency of each fund.

3. What is Dual DCA Strategy?

In simple terms, it involves using AI DCA strategy to simultaneously deploy long and short position trading robots on the same underlying asset.

When the price falls, the long position will be continuously held and additional positions will be added at a predetermined percentage decline, while the short position will take profit when the price reaches a set percentage increase. Conversely, when the price rises, the short position will be continuously held and additional positions will be added at a predetermined percentage increase, while the long position will take profit when the price reaches a set percentage increase. If you observe a particular cryptocurrency fluctuating within a certain range for an extended period and anticipate that this market condition will persist for a considerable time, you can engage in the bidirectional arbitrage strategy described above to achieve double profits.

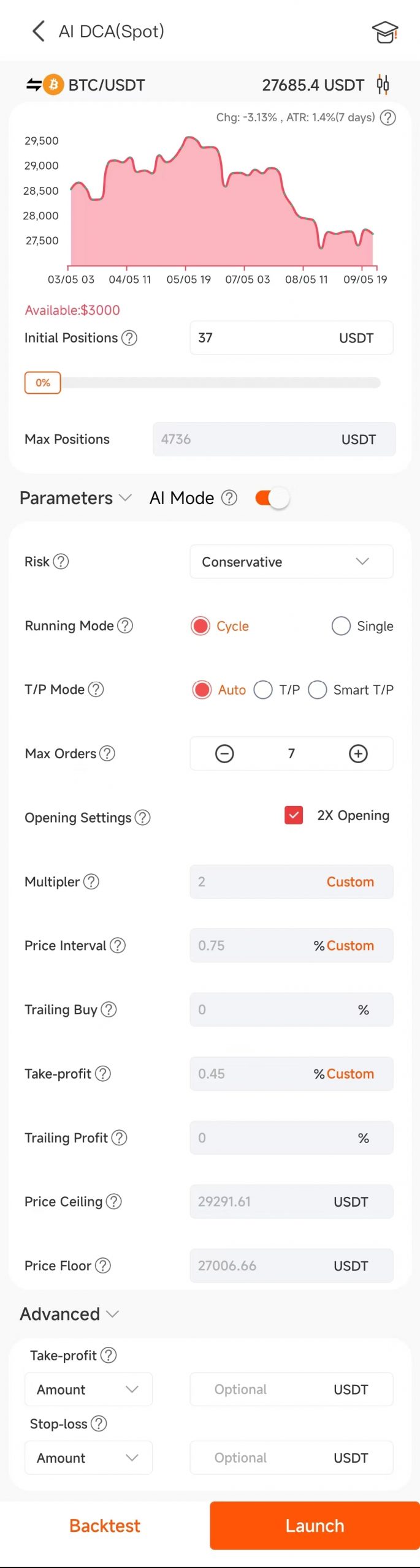

4. Explanation of AI DCA Parameters

[Initial Positions]: The position size when a robot opens its first position from a never-held position. It is recommended that beginners keep the default value.

[Max Positions]: Maximum position allowed for the robot, which is the amount of holdings of the robot that reaches the ‘Max Orders’.

[AI Mode]:

After enabling AI mode, the following parameters can not be manually modified:”Multipler”,”Price interval”,”Trailing Buy”,”Take-profit”,”Trailing Profit”,”Price Ceiling”,”Price Floor”.

In the AI Mode, the system will monitor the market fluctuations of the current assets in real-time and automatically adjust the above parameters to maximize trading efficiency.

[Risk]: Risk level comparison: Aggressive > Steady > Conservative. The higher the risk, the smaller the Price Interval and take-profit ratio when increasing positions.

[Running Mode]:

Auto: When the number of orders exceeds 4, “T/P” automatically switches to “Smart T/P” mode.

T/P: The entire position is liquidated (closed) when the preset take-profit ratio is reached.

Smart T/P: Profits are taken when the price reaches the take-profit ratio of the current last order. If in the volatile market , repeated entries and exits can be made to continuously realize profits.

[Max Orders]: The max number of times the robot is allowed to increase positions in a row. (Start from no positions)

[2x Opening]: When the robot opens positions for the first time, it opens it with double”Initial Positions”. Note: The subsequent increasing amount is still calculated according to “Initial Positions”.

[Mutipler]: The next opening volume is the current opening volume multiplied by the”Multipliers”.

[Price Interval]: Referring to the last open price, the long robot will increase its positions if the market price falls by this preset ratio. Conversely, the short robot will increase its positions if the market price rises by this preset value. (Can be used with”Trailing Buy”).

[Trailing Buy]: When the pullback ratio of the price reaches this preset value and the price meets”Price interval”, the long robot will increase positions; When the recovery ratio of the price reaches this preset value and the price meets”Price interval”, the short robot will increase positions. It is used to balance losing positions and unrealized profits, in order to better control trading risks and maximize returns.

[Take-profit]: The robot will close the position for profit and enter the next cycle when the return reaches this preset value. (Can be used with”Trailing Profit”)

[Trailing Profit]: When the pullback ratio of the price reaches this preset value and the price meets”Grid Interval”, the long robot closes positions; When the recovery ratio of the price reaches this preset value and the price meets”Grid Interval”, the short robot closes positions. It protects profits when the price falls while maximizing profits when the price rises.

[Price Floor]: When the market price is lower than the preset price, both the long and short robots will not open positions but only close positions. The robots will only start to open a new position when the price rises back to the preset price.

[Price Ceiling]: When the market price is higher than the preset price, both long and short robots will not open positions but only close positions. The robots will only start to open a new position when the price falls back to the preset price.

Take-Profit and Stop-Loss

[Take Profit by Price]: If the market price is higher than the preset price, the long robot will automatically close the position and stop running. If the market price is lower than the preset price, the short robot will automatically close the position for take-profit and stop running.

[Take-Profit by Amount]: When PnL plus Floating reach the preset amount, the robot will automatically close the position and stop running.

[Stop Loss by Price]: If the market price is lower than the preset price, the long robot will automatically close the position and stop running. If the market price is higher than the preset price, the short robot will automatically stop loss and close the position and stop running.

[Stop-Loss by Amount]: When PnL plus Floating reach the preset amount, the robot will automatically close the position and stop running.

Smart T/P What is it for?

Smart T/P (also known as grid profit taking, tail profit taking)

Tail profit taking is in contrast to the overall profit taking of a position. Overall profit taking means that when the current price reaches the predetermined profit taking ratio, the entire position is cleared and sold for profit. Smart T/P is a further optimization of tail profit taking. When the system’s position reaches 25% of the expected total position and the price rises to the profit taking point of the last position, the tail position is triggered to sell and take profits.

Pros and cons of Smart T/P:

After enabling Smart T/P, profits can be obtained even if the current price has not reached the overall profit taking point of the strategy, which is particularly suitable for the situation where the price stays in a range for a long time after a half-trend.

If the price oscillates near the tail profit taking point, it may keep building positions and taking profits, thus constantly profiting in the oscillating market.

However, after enabling Smart T/P, when the price quickly returns to the overall profit taking point, the profit from the partitioning strategy will be lower than that of the overall profit taking. In addition, after the tail position is profit taken, the average holding price will increase, and the overall profit taking point will move up, which affects the overall profit taking cycle.

You can choose whether to enable Smart T/P according to the current market situation and your own needs.

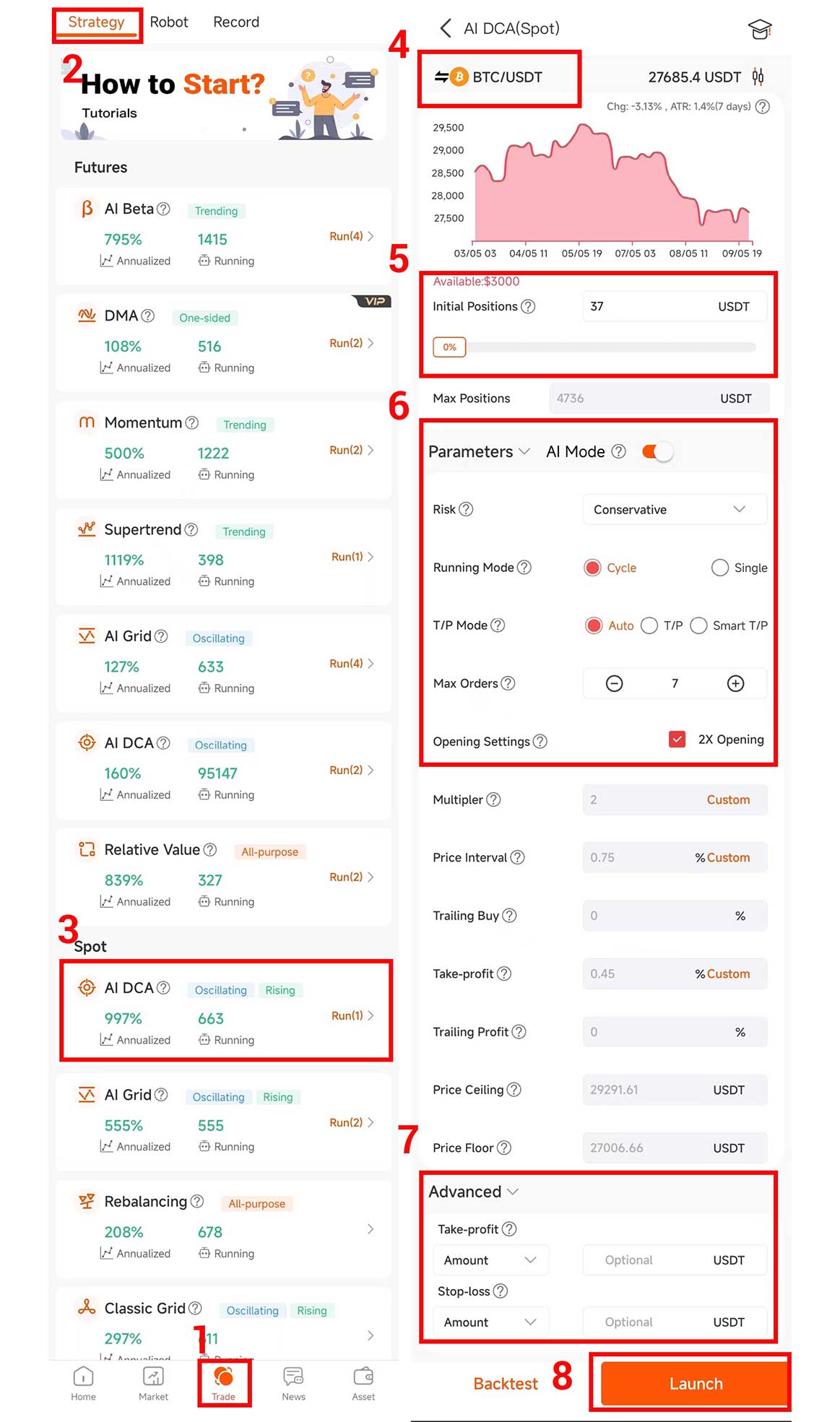

5. How to start a bot of AI DCA Bot?

Before starting the robot, you need to complete two steps: 1. Bind the API key of the exchange and ensure that the corresponding futures or spot account of the robot has sufficient funds; 2. Purchase the energy for starting the AntBot robot or activate AntBot VIP.

Summary: The AI DCA trading strategy will adjust the position increment interval in real time according to the current market conditions of each asset, and set up stop-profit and stop-loss mechanisms to control risk. Its main advantages include:

Strong adaptability: real-time adjustment of position increment interval and stop-profit ratio according to current market conditions, avoiding risks caused by a single fixed trading action in traditional Martingale strategy.

Strong risk control ability: setting stop-profit and stop-loss mechanisms to close positions in time to control risk.

High profitability: maximizing trading efficiency by dynamically adjusting trading volume.

Overall, the intelligent Martingale trading strategy is a relatively robust trading strategy that can adapt to different market conditions and has a certain level of risk control ability.