What Is the Dual Grid Trading Strategy?

Content:

- How Does the Dual Grid Work?

- What Problems Does the Dual Grid Strategy Solve?

- Introduction to Parameters of Dual Grid Strategy

- AntBot’s Pros and Cons of Dual Grid Trading Strategy

- Guides You to Start the Dual Grid Bot Step by Step

1. How Does the Dual Grid Work?

Dual Grid trading strategy is a futures grid strategy that allows both long and short positions and is suitable for oscillating markets. The strategy involves two robots. Whenever one robot generates profits and closes a grid position in the current trend direction, the other robot incurs floating losses and establishes a new grid position. This process is repeated continuously, which is the characteristic of Dual Gridoperation. The strategy is an extension of AntBot AI Grid and Dual Grid can be viewed as two independently operated AI Grid futures robots with opposite directions and a leverage ratio of 5 times. In a volatile market, the two robots independently manage their own grid trading to achieve profit locking. This is the principle of profit in Dual Grid. Dual Grid trading strategy helps to achieve the total profit target faster and minimize the drawdown.

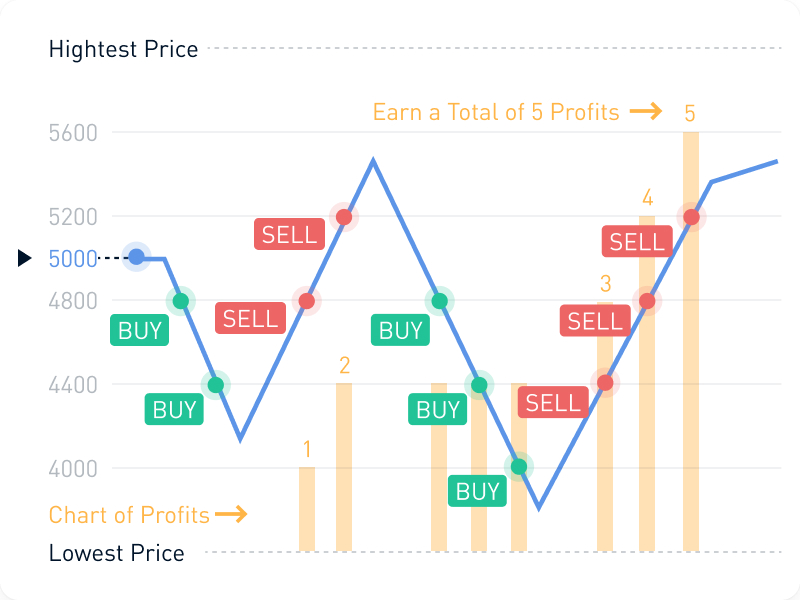

As shown in the chart below:

2. What Problems Does the Dual Grid Strategy Solve?

The Dual Grid is one of the original strategies created by the AntBot team, which perfectly solves the three major problems of classical grid strategies.

2.1 No profit is generated beyond the grid range. The Dual Grid runs two robots in both long and short directions, generating profits regardless of whether prices rise or fall.

2.2 Low capital efficiency. Compared with the one-way grid strategy, the Dual Grid strategy can automatically increase positions and obtain more profits during continuous opposite market trends. As it runs two robots in both long and short directions, if the price continues to fall, the long robot will increase positions, while the short robot will continue to close positions and make a profit. Conversely, if the price continues to rise, the short robot will increase positions, while the long robot will continue to close positions and make a profit. In this way, by preparing one amount of capital to add positions to one direction of the robot, two profits can be obtained, while taking on one amount of capital risk.

In addition, the Dual Grid strategy will formulate their respective grid ranges based on different support and resistance levels and volatility of different assets to balance the risk and reward ratio.

2.3 Inability to adjust in a timely manner after breaking the price range (breaking the grid) The Dual Grid has no upper and lower price boundaries. After breaking one side of the grid, the AI system will recalculate the support and resistance levels, repurchase the initial position, and follow the price to make a profit by closing the position one grid at a time when the price continues to move in one direction.

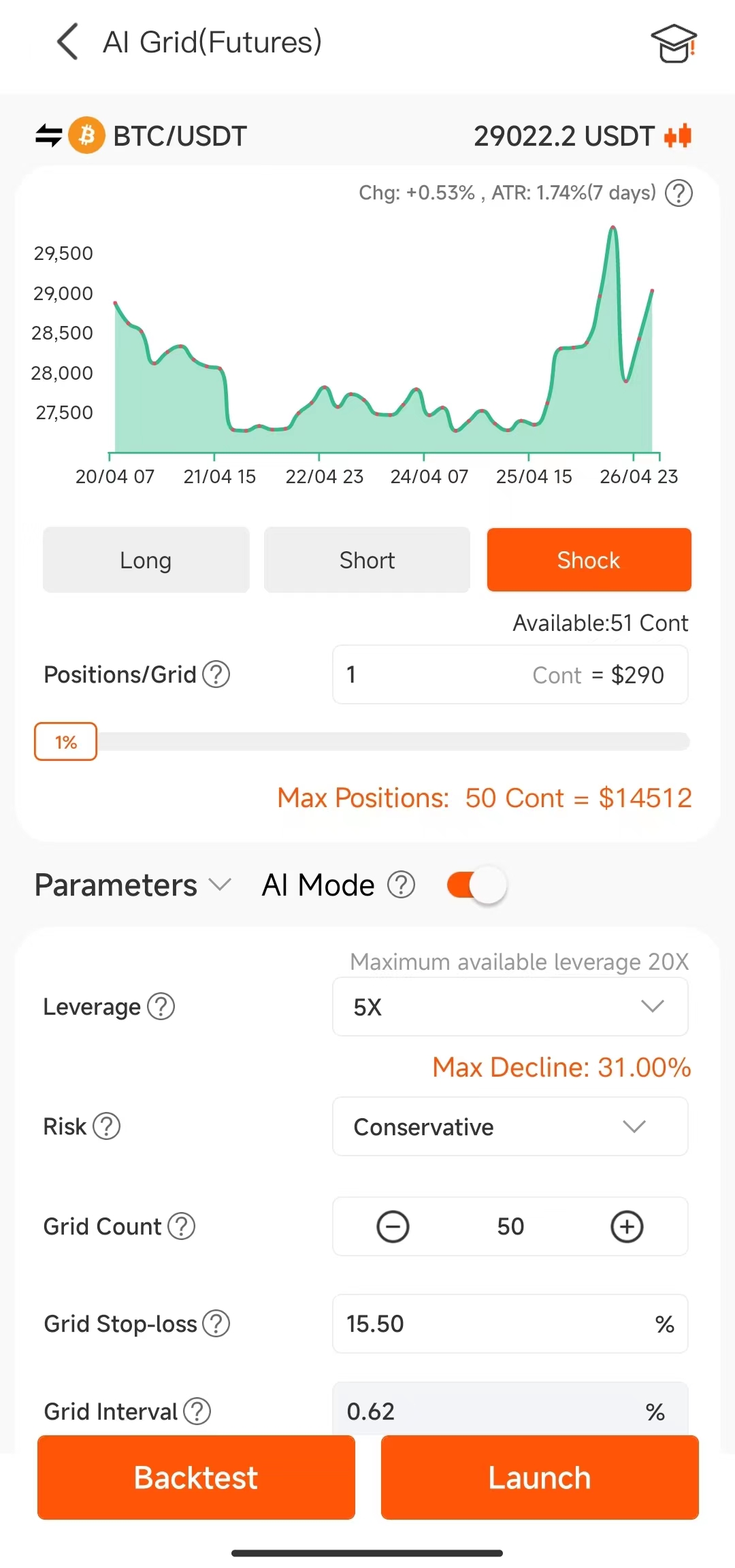

3. Introduction to Parameters of Dual Grid Strategy

Long: Only open long and close long positions, suitable for upward-trending markets.

Short: Only open short and close short positions, suitable for downward-trending markets.

Oscillation: Simultaneously open long and short positions, suitable for range-bound oscillating markets.

4. AntBot’s Pros and Cons of Dual Grid Trading Strategy

Pros:

- The Dual Grid strategy does not rely on market trends and can achieve profits in both rising and falling markets.

- It is highly effective in volatile and directionless markets, especially when prices fluctuate rapidly within the grid interval.

- There are no limit orders, and both long and short positions share margin to increase capital efficiency.

- The grid profit-taking ratio is set by default to prevent liquidation and greatly reduce capital risk.

Cons:

- The strategy requires frequent trading, so the cost of trading fees needs to be considered.

- The effectiveness of the strategy is not ideal when the market price fluctuates significantly or when the price tends to trend in one direction for a long time.

- In order to increase capital utilization, AntBot uses market orders for all strategies. However, the grid strategy requires independent settlement of profit and loss for each trading order, while the exchange settles profit and loss based on the average holding price. This may lead to inconsistencies between AntBot’s profit and loss calculations and the exchange’s profit and loss calculations, which may cause inconvenience for traders. Therefore, we recommend that traders abandon the exchange’s settlement method and use AntBot’s trading records as the basis to ensure consistency in profit and loss calculations.

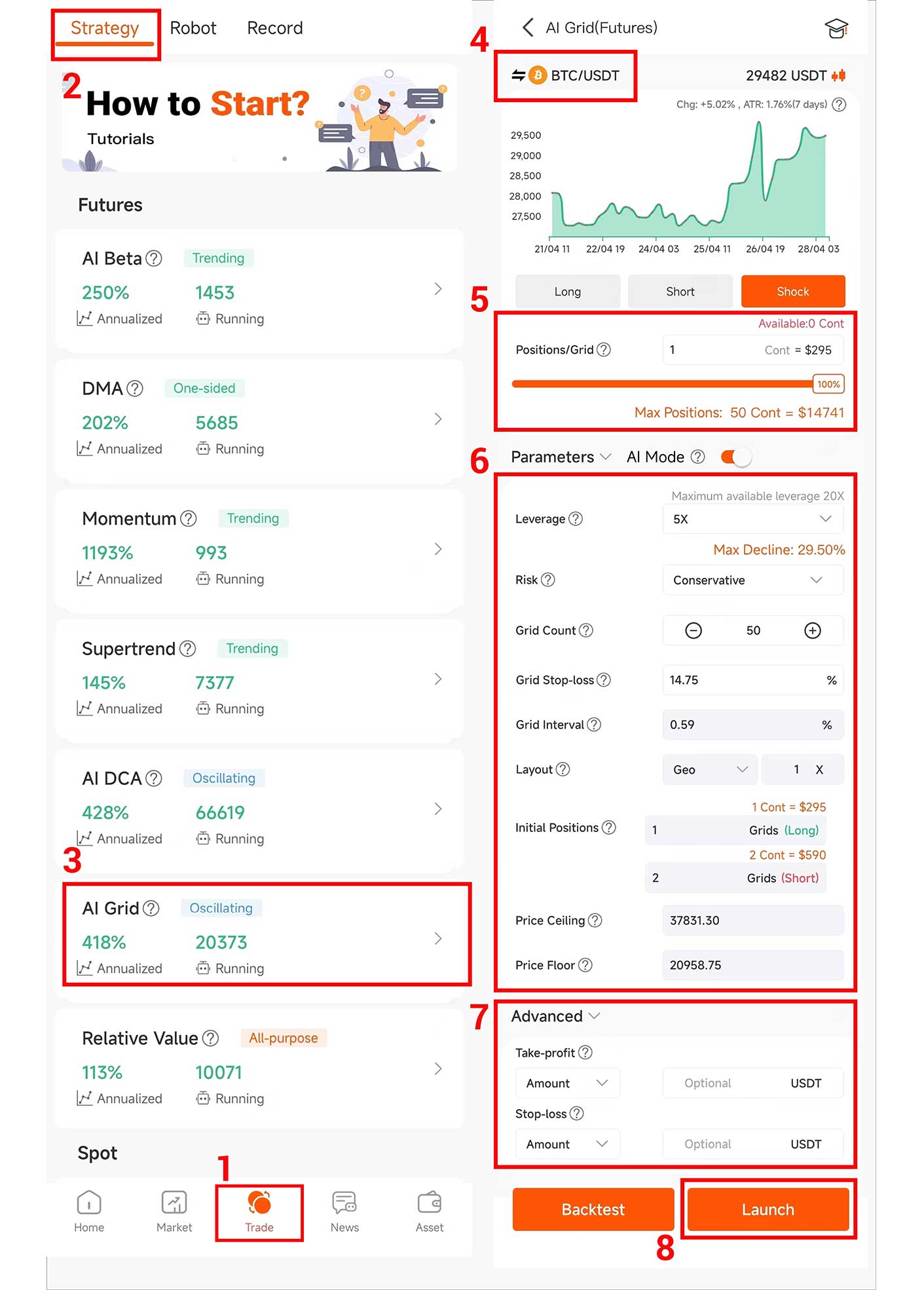

5. The Following image guides you to start the Dual Grid bot step by step

Before starting the robot, you need to complete two steps: 1. Bind the API key of the exchange and ensure that the corresponding futures or spot account of the robot has sufficient funds; 2. Purchase the energy for starting the AntBot robot or activate AntBot VIP.