What Is the AI Beta Trading Strategy?

Contents:

- What Is The AI Beta Trading Strategy?

- AI Beta Strategy Features

- How to Reduce Risks

- The Video Below Is AntBot doing a Visual Backtest of AI Beta

- AI Beta Strategy Backtesting Results and Robustness Analysis

- How to Start an AI Beta Bot

What Is The AI Beta Trading Strategy?

The most popular long-term strategy across financial markets is trend following. This strategy has proven to be highly profitable under favorable market conditions. Its approach is simple and has been successfully used by both famous and unknown traders, past and present.

The AI Beta strategy, developed by crypto experts and technical team from AntBot, is based on the principle of support and resistance. It captures real-time changes in the price-volume relationship to find optimal entry and exit points. It uses the ATR trailing stop method and integrates multiple strategy models, leveraging computer algorithms and trend ideas.

After more than twelve months of real money testing, AI Beta has demonstrated excellent performance across different cryptocurrencies and markets.

No strategy is foolproof in all market conditions. The AI Beta strategy is designed to adapt to adverse markets by timely implementing stop-loss orders based on the volatility of different crypto assets and positions. This feature makes the AI Beta strategy suitable for futures trading, as it prevents trapped funds and position bursts.

AI Beta Strategy Features

1. Long and short linkage, if the resistance level is broken, take long position, if it falls below the support level, take short position.

2. Real-time monitoring of 2x ATR trailing stop.

3. Capture the information on the price-volume relationship to optimize entry and exit points.

4. If the trend is broken, the position is increased multiple times.

5. ATR is used to draw up initial positions for different targets.

How to Reduce Risks

- Robots running 15 mainstream cryptos at the same time to diversify risk.

- Each robot opens positions with 1% of the account funds.

- Based on the position management principle of “increase positions in profits and decrease positions in losses”, the position opening amount is moderately added under the continuous take-profit market, and the position opening amount is moderately reduced under the continuous stop-loss market.

The Video Below is AntBot doing a Visual Backtest of AI Beta

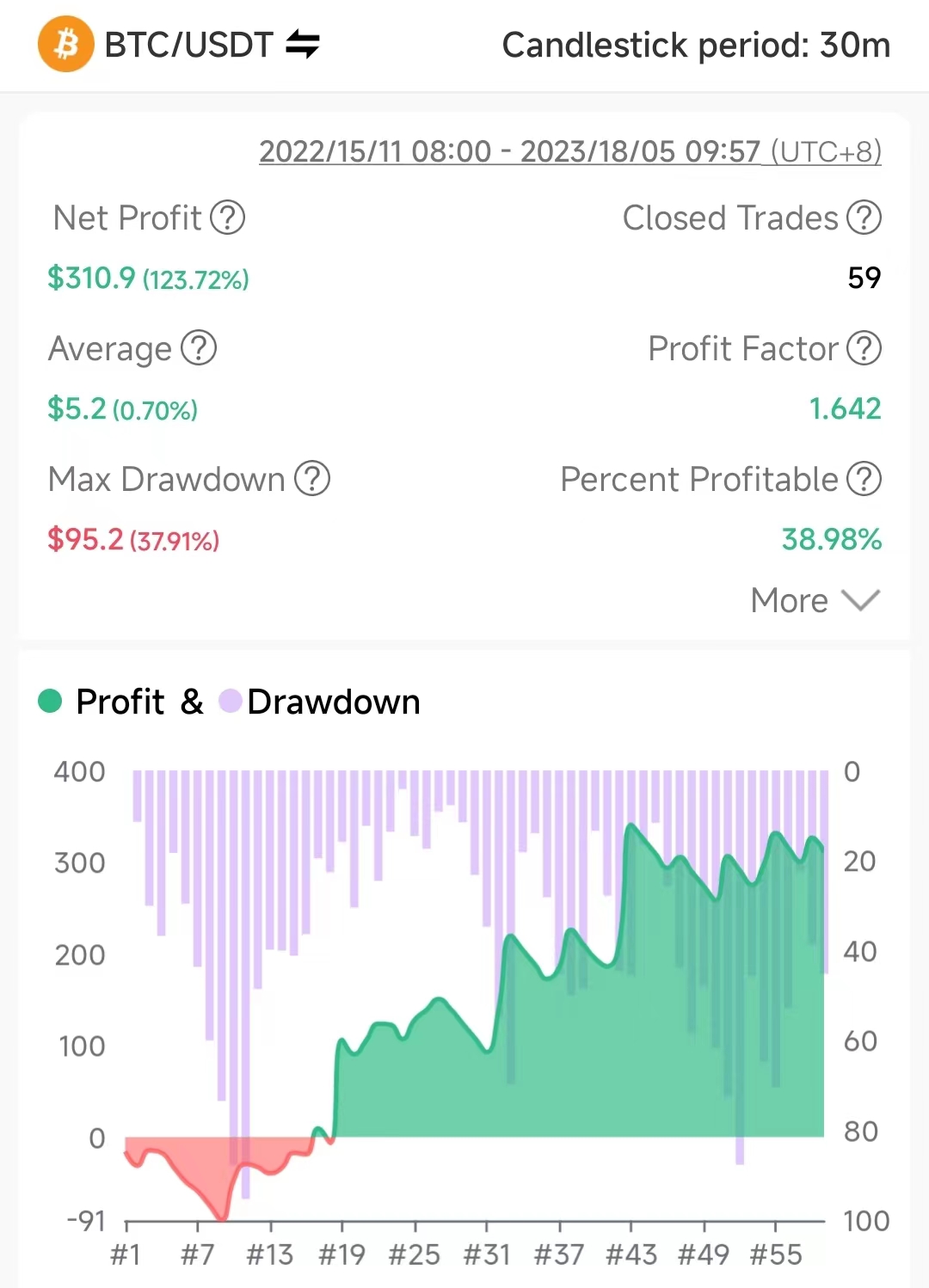

AI Beta Strategy Backtesting Results and Robustness Analysis

Period: 30 minutes

Crypto: BTCUSDT

Fees: 0.04%

How to Start an AI Beta Bot

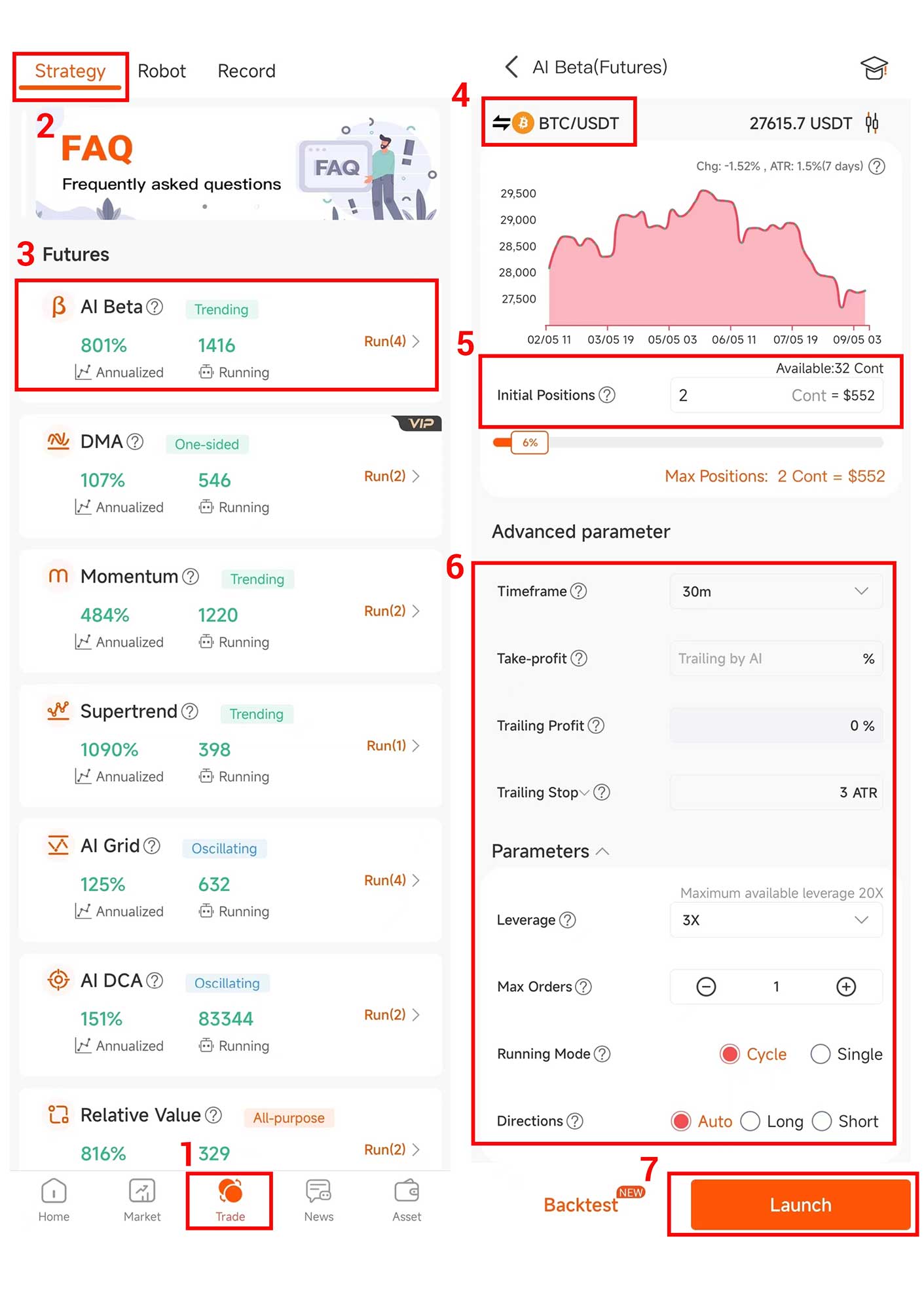

1. Log into your AntBot account to find [AI Beta] in the [Robot] of the [Trades] interface and click the button on the right to enter the parameter setting page.

2. Choose crypto based on personal criteria and preferences.

3. Fill in [Initial Positions], or slide the box below to set it. Beginners are advised to keep the default value.

- [Initial Positions]: The amount of the robot’s open position by the first time.

4. It is recommended that novices keep the default values of all detailed parameters, and directly click [Launch] to run the robot.

- [Leverage]: Using leverage can be regarded as borrowing funds from the exchange to hold positions. The multiple of this position funds relative to the principal is the leverage, and increasing leverage will magnify profits and losses. It is recommended to keep the default value of 5x leverage for beginners.

- [Max Order]: The maximum number that bots are allowed to increase positions consecutively from the state of unopened position.

- [Running Mode]: It is divided into cycle and single. Cycle means that the robot will repeat the next round of opening positions after each take-profit and closing position, and the robot will only stop when it reaches the profit or loss conditions preset in the [Take-Profit] and [Stop-Loss]. Single means that the robot will automatically terminate the operation after completing a cross-position take profit.

- [Auto]: According to the trading signal, going long when a long position signal is released, and going short when a short position signal is released.

- [Long]: Only run long position signal.

- [Short]: Only run short position signal.

- [Take-Profit]

1. [Trailing By AI] is the default value, the robot calculates the signal every 30 minutes. When the signal reverses, it will take profit and close the positions, and the robot will enter the next cycle.

2. If there is a preset ratio value, the robot will close the position and take profit when the rate of return of the robot’s position reaches the preset value, and the robot will enter the next cycle.

- [Stop-Loss]

1. [Trailing By AI] is the default value, when the robot builds a position, it pre-embeds the stop loss ratio according to the real price fluctuation of the 30-minute period. When the position loss rate reaches this preset value, it will close the position and stop loss, and the robot will enter the next cycle.

2. If there is a preset ratio value, the robot will close the position and stop the loss if the loss rate of the robot’s position reaches the preset value, and the robot will enter the next cycle.

Before starting the robot, you need to complete two steps: 1. Bind the API key of the exchange and ensure that the corresponding futures or spot account of the robot has sufficient funds; 2. Purchase the energy for starting the AntBot robot or activate AntBot VIP.