What Is the AI Grid Trading Strategy?

Contents:

- What is the AI Grid Trading Strategy?

- How Does the AI Grid Work?

- AntBot’s AI Grid Trading Has the Following Features

- Introduction to Parameter

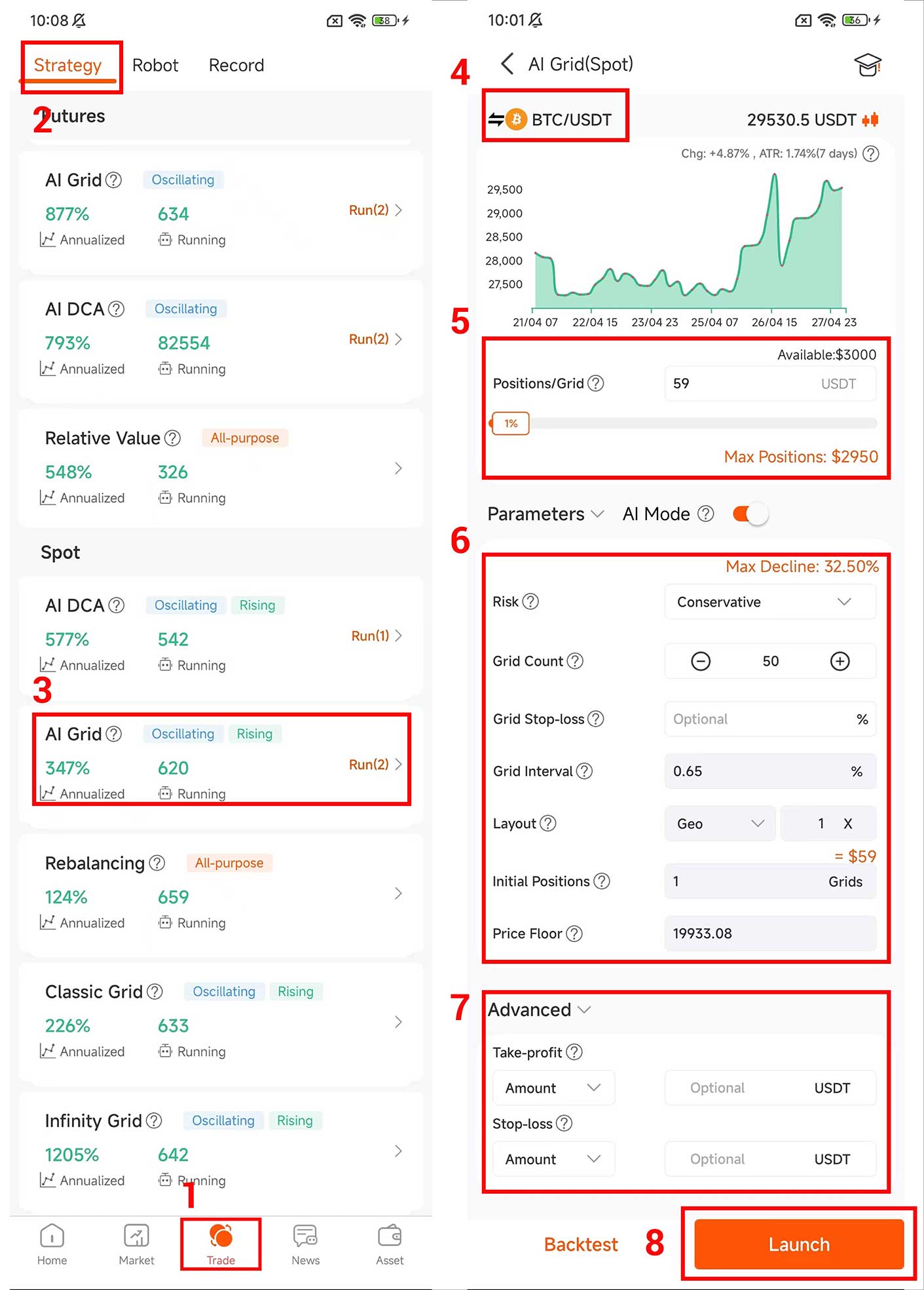

- How to start a bot of AI Grid?

1. What is the AI Grid Trading Strategy?

The AI Grid trading strategy is a oscillating trading strategy deeply optimized for profit/risk ratio based on the Classic Grid Strategy by AntBot’s quantitative team.

This strategy is essentially a sliding grid strategy, where traders only need to set the lowest price, and the system will follow the market to track buy orders, which is very suitable for oscillating and rising markets. It solves the problem of classic interval grids that may cause missed entry opportunities in a continuous uptrend. At the same time, the strategy sets a grid stop-loss function. When the price continues to fall, it will gradually close positions by each grid’s fund loss ratio to reduce risks and improve fund liquidity.

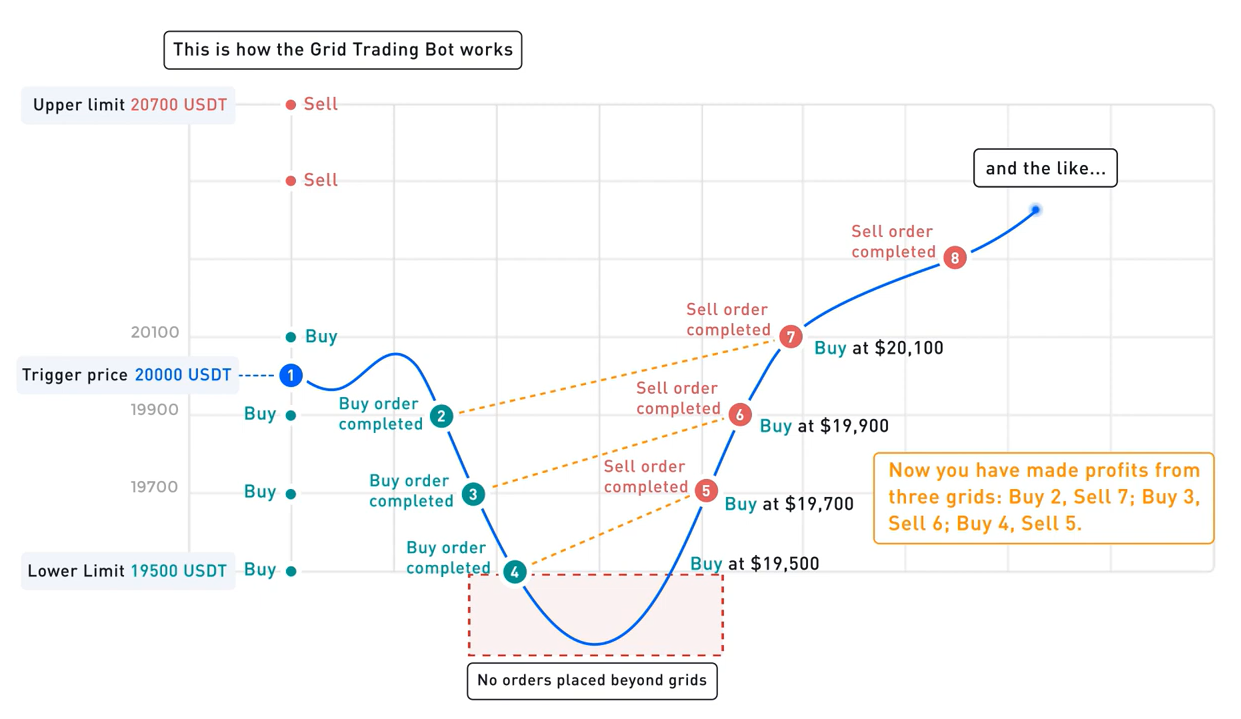

2. How Does the AI Grid Work?

The trader first sets the minimum support price for the current currency by adjusting the number of grids and the grid spacing. The robot will buy one unit every time the currency price falls one grid, and distribute the expected funds evenly to each grid until all the preset grids hold positions. When the currency price rises one grid, the robot will sell one grid, and each selling price is higher than the buying price by the difference of one grid, until all the grids do not hold positions. At this time, the trader will layout multiple grids of positions at one time based on the number of positions set for the first time to avoid missing profits if the price continues to rise. By constantly buying low and selling high in this way, you can continuously earn volatility returns in oscillating market conditions.

3. AntBot’s AI Grid Trading Has the Following Features

- Calculation of grid spacing It first calculates the true volatility of the current currency based on the ATR algorithm and calculates the grid spacing ratio based on this volatility.

- Calculation of initial positions Then, using the Support/Resistance V2 algorithm, it calculates the nearest resistance level above the price, and the initial position size can be calculated based on this resistance level (resistance level price – current price) / grid spacing. The initial position and grid spacing calculated using the resistance level and true range can greatly ensure that the grid spacing of each currency is supported at the lowest price limit while capturing the most waves, in other words, ensuring maximum profits when the supported price drops the most.

- Calculation of the lowest price Based on the above results, the minimum price limit that can be supported can be calculated under a specified number of grids. The price limit represents the size of the grid layout of this robot, and the larger the grid, the denser the grid, the wider the range of market conditions that can be adapted, and the stronger the profit potential. The direct way to increase the size and density of the grid is to increase the investment of capital. Increasing the grid spacing can also reduce the price limit, but the robot will miss the profit of small waves. Understanding and using the above features well can greatly balance the relationship between capital, risk, and profit.

- How to set the grid stop loss Traders can balance capital risk and returns by adjusting the grid stop loss value. The closing stop-loss percentage of each grid is equal to the actual maximum holding grid quantity (i.e., the grid stop loss value) multiplied by the grid spacing. This multiplication is a percentage. Traders can adjust the grid stop-loss value based on their own capital situation and the recent support level of the currency, in order to obtain the best return while reducing the risk of being trapped.

4. Introduction to Parameters

- [AI Mode]: After enabling AI mode, the following parameters can not be manually modified:”Grid Interval”,”Layout”,”Initial Positions”,”Price Floor”. The cloud-based AI algorithm will monitor market fluctuations in real time and automatically adjust the above parameters to maximize trading efficiency.

- [Positions/Grid]: The number of fixed assets invested in each grid. A higher amount of invested assets implies higher risks and potential returns.

- [Grid Interval]: When the robot moves according to the set ratio, it creates a price difference between the two grids. This is used to open new grids or to close existing grids for take-profit.

- [Grid Count]: Maximum limit on the number of grids.

- [Risk]: Risk level comparison: Aggressive > Steady > Conservative. The higher the risk, the smaller the price gap and take-profit ratio when increasing positions.

- [Price Floor]: The lowest price is expected to be supported. When the market price reaches this price, all grids will hold positions. Increasing the grid interval or grid count can reduce this price.

- [Grid Layouts]:

Geometric,The price distance of each grid is multiplied by a fixed ratio, for example, 1, 1, 1, 1. The ratio between adjacent prices remains constant. This type of grid layout provides a more stable trading experience in markets with stable prices or small fluctuations.

Arithmetic, The price distance of each grid is added by a fixed value, for example, 1, 2, 3, 4. The difference between adjacent prices is equal. This type of grid layout is suitable for markets with large fluctuations in prices, especially when prices are rising or falling. - [Initial Positions]:The robot opens positions by laying out a certain number of grids at once while it has no position. It is designed to cope with the possibility of missing the entry opportunity due to continuous price increases.

Take-Profit and Stop-Loss

- [Take Profit by Price]: If the market price is higher than the preset price, the long robot will automatically close the position and stop running. If the market price is lower than the preset price, the short robot will automatically close the position for take-profit and stop running.

- [Take-Profit by Amount]: When PnL plus Floating reach the preset amount, the robot will automatically close the position and stop running.

- [Stop Loss by Price]: If the market price is lower than the preset price, the long robot will automatically close the position and stop running. If the market price is higher than the preset price, the short robot will automatically stop loss and close the position and stop running.

- [Stop-Loss by Amount]: When PnL plus Floating reach the preset amount, the robot will automatically close the position and stop running.

5. How to start a bot of AI Grid?

Before starting the robot, you need to complete two steps: 1. Bind the API key of the exchange and ensure that the corresponding futures or spot account of the robot has sufficient funds; 2. Purchase the energy for starting the AntBot robot or activate AntBot VIP.