The Role of Backtesting in Trading?

Backtesting plays a crucial role in the field of finance and trading. Here are some key roles that backtesting serves:

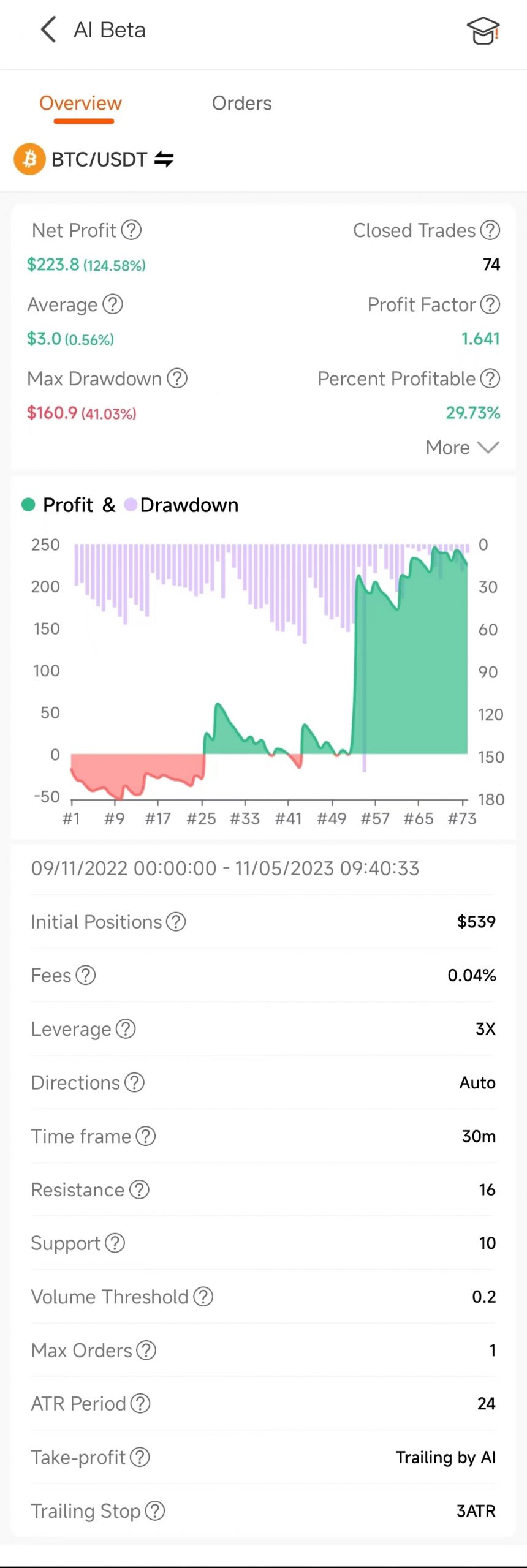

- Performance Evaluation: Backtesting allows traders and investors to assess the historical performance of a trading strategy or investment approach. By applying the strategy to past market data, they can evaluate how it would have performed in real-world conditions. This helps determine the strategy’s potential profitability and effectiveness.

- Risk Assessment: Backtesting helps in understanding the risks associated with a trading strategy. By analyzing historical performance, traders can assess factors such as drawdowns, volatility, and risk-reward ratios. This enables them to make informed decisions regarding risk management and position sizing.

- Strategy Optimization: Backtesting provides a platform for refining and optimizing trading strategies. By testing different parameters, variables, or rules, traders can identify the optimal settings that yield the best performance. This process helps fine-tune the strategy and adapt it to changing market conditions.

- Decision Support: Backtesting results serve as valuable information for decision-making. Traders can use the historical performance data to evaluate different strategies, compare their outcomes, and make informed choices about which strategies to deploy in live trading.

- Confidence Building: Backtesting allows traders to gain confidence in their strategies before committing real capital. By simulating trades and observing historical results, traders can validate their strategies and develop trust in their ability to perform well in the markets.

Overall, backtesting is a vital tool in finance and trading that helps evaluate performance, assess risk, optimize strategies, support decision-making, and build confidence. It is an essential step in the development and implementation of successful trading approaches.